ADVANCED ALERTS

Hedge mode alerts on TradingView

Some exchanges, like Binance, Oanda, MT4/MT5, ByBit and Bitget, support what is called hedge mode. It has the benefit, that you can run several strategies on the same ticker, e.g. BTCUSDT, with the strategies not closing each others positions. Functionally, the difference in behavior is the exchange will allow holding positions in both short and long directions at the same time.

Trading Multiple Strategies using hedge mode

Imagine you have two trading strategies — Strategy A and Strategy B. Strategy A has identified a potential long opportunity, while Strategy B has spotted a short opportunity at the same time. If you were using a single strategy approach, you would have to choose between the two, and if the chosen strategy underperforms, your entire portfolio would be negatively affected.

However, by employing multiple strategies with smaller order sizes, you can execute both long and short positions simultaneously, allowing each strategy to play out independently without affecting the other. This approach reduces the overall risk and provides a more balanced return profile for your portfolio.

To effectively implement multiple strategies, it’s essential to use hedge mode on your exchange and choose an automation solution that supports it, like Tickerly. Hedge mode allows different strategies to hold long and short positions without closing out each other’s positions. This feature is invaluable when managing multiple strategies, as it enables you to maintain exposure to a variety of trading opportunities without compromising your existing positions.

(Read our blog post here about why running multiple strategies on the same ticker using hedge mode might be a good approach)

Hedge mode alerts

To use hedge mode, the alert structure is slightly different, but just as easy to implement:

{ "hedgemode": "hedge", "ticker": "{{ticker}}",

"action": "{{strategy.order.action}}",

"prev_position" : "{{strategy.prev_market_position}}",

"quantity": "{{strategy.order.contracts}}",

"pointer" : "replace with pointer for your exchange here"

}

All above elements are mandatory and the order will not be placed if one element is missing. If you use the above elements, it will replicate your strategy orders exactly, but each of the middle four elements can be manually overridden with manual values which you can read about here.

SET UP EXCHANGE FOR HEDGE MODE

Setting up your exchange for hedge mode

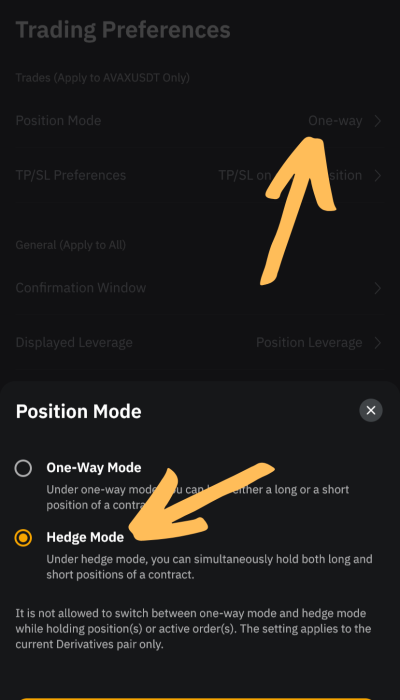

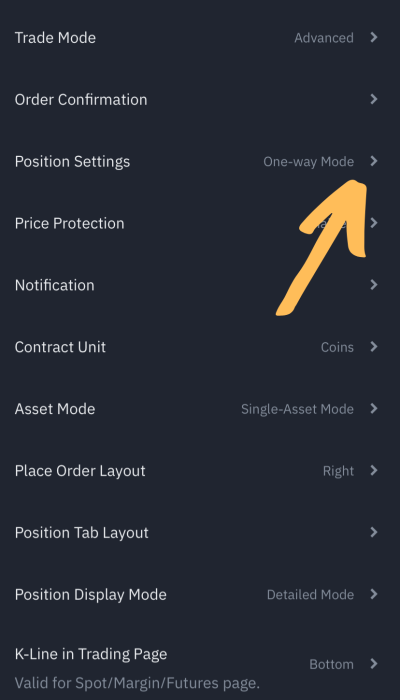

For most exchanges (except Bitget), the default hedge mode is “one-direction” and to use hedge mode signals, you need to set the hedge mode on your exchange to “hedge”.

TRADING AUTOMATION

Setting strategy hedge mode alerts on TradingView

The proces for setting hedge mode alerts is the same as the standard process. Only make sure to use the alert message structure showed above after you’ve set your exchange to hedge mode too.