Limit order alerts

At Tickerly, we’ve engineered a way for you to place limit orders on your chosen exchange. This feature becomes indispensable since some exchanges, like Deribit, necessitate this order type. Furthermore, it can be beneficial for certain trading scenarios. However, do bear in mind that Tickerly, in its present form, does not have the capacity to eliminate unwanted limit orders or update existing ones.

Your strategy or indicator will need to provide a bit more information for this feature, and there may be instances where support isn’t available. In such cases, you’re always free to fall back on the standard alert message structure.

Additional alert structure details

- type

This determines the type of order you send. If this element is not sent, Tickerly defaults to Market orders. If you want to place a limit order, you should put the word “limit”. You can also send the word “market” which enforce that Tickerly should place a market order in this situation - price

This determines the price at which you want to place the limit order. Only if the price on the exchange hits this level will the order be filled at the price sent in this field. If you are trading BTCUSDT, for instance, this could be “19000” to place an order to buy when price comes down to 19000 USDT.

Limit order strategy message

{

"ticker": "{{ticker}}",

"action": "{{strategy.order.action}}",

"prev_position" : "{{strategy.prev_market_position}}",

"quantity": "{{strategy.order.contracts}}",

"type": "limit",

"price": "{{close}}",

"pointer" : "replace with pointer for your exchange here"

}Directional limit order alerts

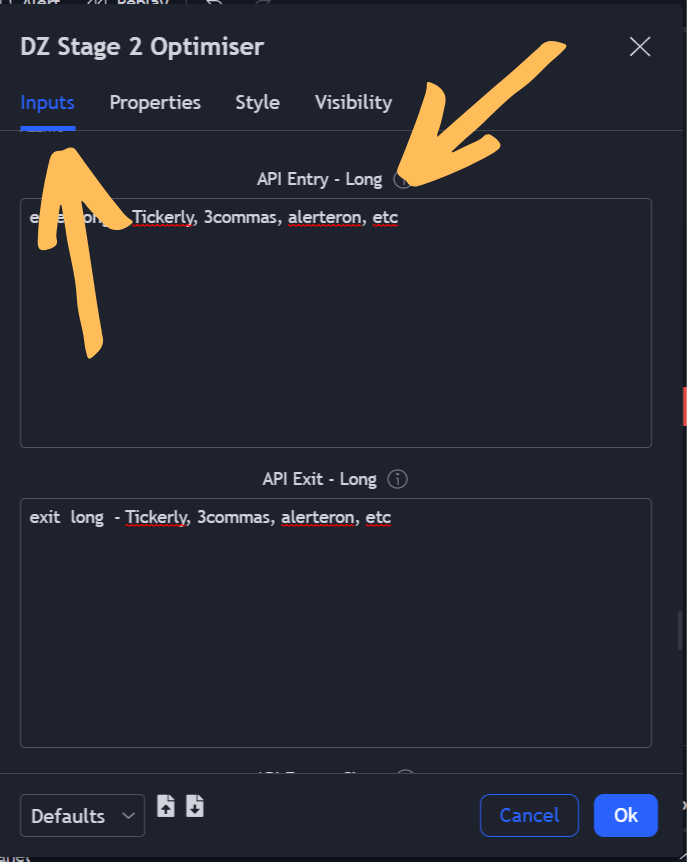

You can configure the alert messages inside the strategy or indicator, if your strategy has input boxes for entering custom messages on enter long, exit long, enter short and exit short respectively.

This requires that your strategy is able to replace some placeholder values with the values generated by the strategy for a trade. It typically takes the form of, for instance, #quantity# which will be replaced by the size of the order price by your strategy script. Note that the placeholder names might be different for your strategy. If your strategy supports this, then use the below alert structures for your enter long and enter short full trade alerts.

Enter long limit order alert message

{

"ticker": "#symbol#",

"action": "buy",

"prev_position" : "flat",

"quantity": "#quantity#",

"type": "limit",

"price": "#longEntryPrice#",

"pointer" : "replace with pointer for your exchange here"

}Exit long limit order alert message

{

"ticker": "#symbol#",

"action": "sell",

"prev_position" : "long",

"quantity": "#quantity#",

"type": "limit",

"price": "#longTpPrice#",

"pointer" : "replace with pointer for your exchange here"

}Enter short limit order alert message

{

"ticker": "#symbol#",

"action": "sell",

"prev_position" : "flat",

"quantity": "#quantity#",

"type": "limit",

"price": "#shortEntryPrice#",

"pointer" : "replace with pointer for your exchange here"

}Exit short limit order alert message

{

"ticker": "#symbol#",

"action": "buy",

"prev_position" : "short",

"quantity": "#quantity#",

"type": "limit",

"price": "#shortTpPrice#",

"pointer" : "replace with pointer for your exchange here"

}All above elements are mandatory and the order will not be placed correctly, if one element is missing.

Alert messages when using strategy inputs

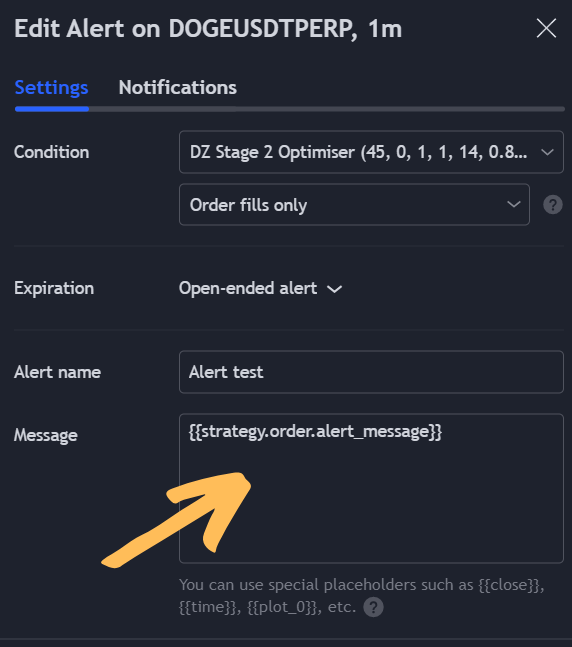

Note that when settings alerts when using strategy input fields, you use a simpler message in the alert message box. In most cases is will be:

{{strategy.order.alert_message}} That will make your strategy alerts message look like this:

But there are also some strategies which use

{{strategy.order.comment}}Refer to the details of your strategy and test which works for your strategy.