DCA Bot

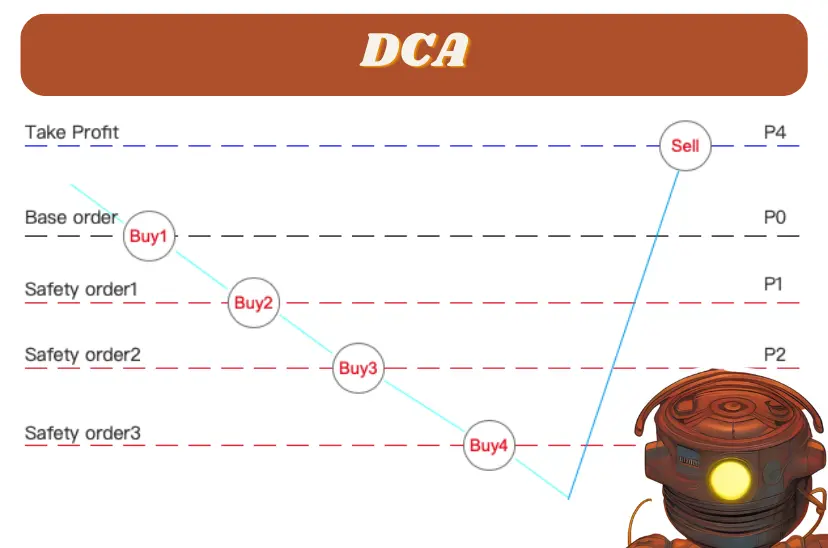

A DCA Bot uses Dollar-cost averaging (DCA) as a well-established investment strategy, originally designed to reduce the impact of volatility on substantial purchases of financial assets like equities or cryptocurrencies. The DCA strategy can be implemented based on either fixed time intervals or predetermined price levels.

Here’s an in-depth look at how it works:

- Regular Investment: Determine the total amount you wish to invest in a particular asset. Then, choose the conditions under which you want to make these investments. The conditions can be time-based (weekly, monthly, or even daily) or price-based (whenever the asset hits certain price levels), depending on your investment strategy and risk tolerance.

- Fixed Amount: Whether you’re investing at regular intervals or upon reaching specific price points, you invest a fixed amount. The key here is consistency: irrespective of whether the asset’s price is high or low, you continue to invest the same sum.

- Automatic Adjustment to Market Conditions: In a time-based DCA strategy, your fixed investment buys more of the asset when the price is low and less when the price is high. This potentially lowers the average cost per asset over time. In a price-based DCA strategy, you take advantage of specific price levels to strategically invest your money, attempting to maximize the value you receive from market fluctuations.

- Mitigating the Impact of Market Fluctuations: DCA aims to minimize the effects of market volatility. By spreading investments across different times or price points, you reduce the risk of investing a large amount in a single transaction at an unfavorable price.

In essence, the DCA strategy is a disciplined investment approach that mitigates risks and removes the emotional component from investment decisions. Regardless of whether you’re investing at regular intervals or specified price points, you eliminate the need to “time the market,” thus reducing stress and potential mistakes linked to impulsive investment decisions. This strategy is particularly suitable for assets with high price volatility, like cryptocurrencies, and for investors with long-term investment horizons.

Types of DCA Bot Strategies

Employ the Tickerly Automated DCA bot in a variety of ways:

- Fixed Interval DCA: Set your bot to buy a predetermined amount of a cryptocurrency at regular timeframes, irrespective of its market value. For instance, program the bot to purchase $100 worth of Bitcoin every Monday, helping to spread the cost and limit short-term price volatility effects.

- Price-Based DCA: Direct your bot to buy a cryptocurrency when its price falls below a set level. For instance, configure the bot to buy $100 worth of Bitcoin every time the price drops below $10,000. This strategy allows you to capitalize on market downturns and buy at reduced prices.

- Hybrid DCA: Combine the Fixed Interval and Price-Based strategies. You could set your bot to buy $100 worth of Bitcoin every Monday and an extra $100 whenever the price drops below $10,000.

- Time-Weighted DCA: Let the bot utilize time intervals to decide the cryptocurrency quantity to buy, purchasing more when prices are low and less when they’re high.

Free DCA strategy

A beneficial TradingView script for implementing a DCA trading strategy is the “DCA Backtester & Signals FREE” by user FriendOfTheTrend.

This script allows you to backtest your DCA strategy, offering various customizable options including buy signals, stop loss, take profit percentage, and more. It provides a visual display of your backtesting orders and an info panel for analyzing the strategy’s performance.

It can be paired with Tickerly to send signals based on the set triggers, using the standard alerts.

As always, thoroughly backtest any strategy and understand its intricacies before implementing it in live trading. Ensure your initial capital covers all orders, consider exchange fees, and keep your risk tolerance in mind.

The Pros and Cons of a DCA Bot Strategy

Advantages of Dollar Cost Averaging

- Risk Mitigation: DCA acts as a risk mitigation tool in volatile markets. By spreading out your investment over a period, you reduce the chance of investing a large sum at a potential peak price.

- Reduced Emotional Investing: The DCA strategy can help curb emotional investing, as it encourages a disciplined, consistent approach rather than impulsive, timing-based decisions.

- Beneficial in Bearish and Unpredictable Markets: DCA works well in bearish or unpredictable markets, as it allows for buying assets at reduced prices over time, offering an overall lower average cost.

- Simplicity and Convenience: The DCA strategy is straightforward to implement and manage. With Tickerly’s DCA bot, it becomes even more convenient, as the bot automatically executes your DCA strategy based on the parameters you set.

- Long-term Profit Potential: If you’re optimistic about an asset’s long-term growth, DCA provides a stress-free strategy to accumulate that asset over time, potentially leading to significant profits in the future.

Disadvantages of Dollar Cost Averaging

- Potential Missed Opportunities in Bullish Markets: During a strong bull market, a lump sum investment could potentially lead to higher returns compared to a DCA approach. DCA can cost investors in terms of forgone profits during such market conditions, as it operates on the principle of spreading purchases over time.

- No Guarantee of Profit: Like any other investment strategy, DCA doesn’t guarantee profits. If the asset continually declines in value over a long period, you may end up with an overall loss.

- Requires Discipline and Patience: DCA is a long-term strategy that requires consistency and patience. It might not be suitable for those looking for quick returns.

- Dependent on Regular Investment: For DCA to work effectively, you need to have a steady cash flow that you can regularly invest. It might not be an ideal strategy if you have a lump sum that you want to invest all at once.

Remember, the choice between a DCA strategy and other investment strategies depends on various factors, including your risk tolerance, investment goals, market conditions, and the assets you’re interested in. It’s always a good idea to diversify your investment strategies to balance risk and potential returns.

DCA Versus Advanced Trading Strategies

While the Dollar-Cost Averaging (DCA) strategy is a simple yet effective approach for both beginners and experienced traders, there’s a plethora of advanced strategies that can potentially yield higher returns. These strategies may include complex technical analysis, predictive algorithms, and more.

TradingView’s community of strategies and indicators can be an excellent source to discover and learn about these advanced methods. These strategies are typically created and shared by experienced traders and offer a variety of techniques and perspectives.

With Tickerly, you can easily incorporate these advanced strategies into your trading routine. The automation feature allows you to benefit from the expertise of seasoned traders without the need to manually monitor and execute trades.

Get Started with a DCA BOT

Ready to transform your trading experience? Start using Tickerly’s trading bot with your TradingView alerts today. Join our growing community of traders and step into a world of seamless, automated trading where your alerts are always in action. Sign up for Tickerly today and let your TradingView alerts take flight.